unemployment tax credit check

Web The agency is juggling the tax return backlog delayed stimulus checks and child tax credit payments. Web State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base authorized in RCW 5024010.

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Web Unemployment Benefit Legal Issues.

. Web Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account. Web Maine is issuing 850 stimulus checks to eligible taxpayers on a rolling basis throughout the year in the order that tax returns were received. Even though the chances of speaking with someone are slim.

Web To report unemployment compensation on your 2021 tax return. The Child Tax Credit is expected to roll out July 15. If not you need to file an amended return to report it.

More information is available on our MFA. The first 10200 wont be taxable. Web Broome County Unemployment Office.

You make credit card payments. Cattaraugus County Unemployment Office. 171 Front Street Binghamton NY 13905 607 778-2136 607 778-3011.

Web Beginning September 21 2022 all users will be prompted to set up MFA when using the online unemployment Services portal. Web Nebraska businesses of every size and industry use NEworks to connect with thousands of highly qualified job seekers including a large bank of professionals high-skill. Having legal counsel to obtain unemployment benefits can make a difference.

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of. Web More money is arriving for unemployment-related tax refunds via direct deposit and paper checks. This taxable wage base is.

Nonrefundable credits cannot reduce your tax liability below zero. You may be able to carry unused nonrefundable credits forward to. Web Submit your quarterly unemployment tax payments using your American Express Discover MasterCard or Visa credit card.

It is best to hire an Orangeburg lawyer who handles. And you may get back any. Web Did you include the unemployment on your tax return.

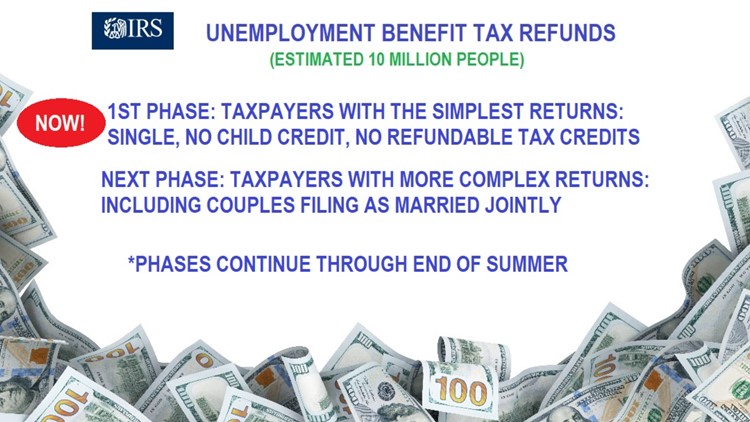

The IRS has just started to send out those extra refunds and will continue to send them during the next several months. Web June 1 2021 435 AM. Web You can still claim the special exclusion for unemployment compensation received in tax year 2020 if you havent filed your 2020 tax return and your AGI is less.

You cannot check it. Web Tax credits fall into one of two categories.

What Is Futa Understanding The Federal Unemployment Tax Act Hourly Inc

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wkrc

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

10 200 Unemployment Refund When You Will Get It If You Filed Taxes Early

Unemployment 10 200 Tax Break Some States Require Amended Returns

How To Calculate Unemployment Tax Futa Dummies

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Do Employees Pay Into Unemployment Futa Suta Tax

When Will Irs Send Unemployment Tax Refunds 10tv Com

How To Claim Your Unemployment Tax Break Under New Stimulus Other Coronavirus Related Tax Matters That S Rich Cleveland Com

Year End Tax Information Applicants Unemployment Insurance Minnesota

Did You Get Unemployment In 2020 You Could See A Tax Refund Soon Wfmynews2 Com

10 200 Unemployment Tax Break Irs Makes More People Eligible

1099 G Unemployment Compensation 1099g

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

Guide To Unemployment Taxes H R Block

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break News Resetera